Description

MYOB & Xero Advanced Certificate in Payroll Training Course

Cloud-based accounting software is always up-to-date so PAYG tables and other information like Superannuation percentages are included with the software with no need to go through an updating/upgrading process.

MYOB & Xero software enables bookkeepers/accountants to perform Payroll processing tasks from wherever they are which is great in the case of sickness or urgent matters.

This course is ideal for:

- Job seekers

- Business owners & office admin staff

- Junior accounts staff who want career progression

MYOB & Xero Payroll Setup

- MYOB & Xero Payroll Course – Setting our user permissions

- MYOB & Xero Payroll Course – Payroll Settings – Linked Account Setup (r)

- MYOB & Xero Payroll Course – Payroll Settings – Payslips Setup

- MYOB & Xero Payroll Course – Payroll Settings – Pay Items Setup

- MYOB & Xero Payroll Course – Payroll Settings – Calendar Setup

- MYOB & Xero Payroll Course – Payroll Settings – Super Setup

Manage your Employees using MYOB & Xero

- MYOB & Xero Payroll Course – Employees – Details

- MYOB & Xero Payroll Course – Employees – Employment

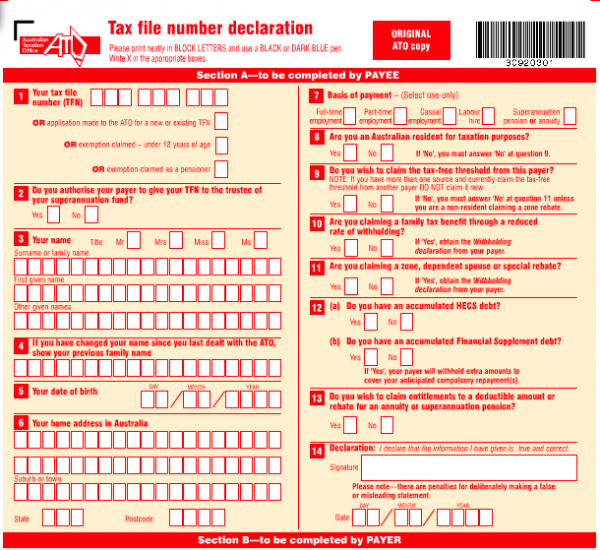

- MYOB & Xero Payroll Course – Employees – Tax Declaration

- MYOB & Xero Payroll Course – Employees – Leave

- MYOB & Xero Payroll Course – Employees – Bank Accounts

- MYOB & Xero Payroll Course – Employees – Pay Template

- MYOB & Xero Payroll Course – Employees – Opening Balances

Processing Payroll using Xero & MYOB

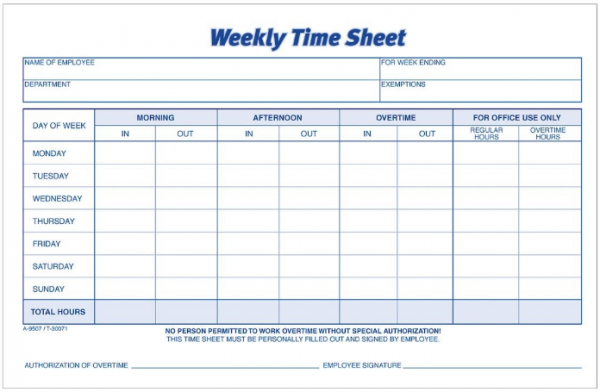

- MYOB & Xero Payroll Course – Timsheets – Entering Timesheet Information

- MYOB & Xero Payroll Course – Pay Runs – Posting a simple pay run

- MYOB & Xero Payroll Course – Pay Runs – Pay Run Options

- MYOB & Xero Payroll Course – Create a New Company File

- MYOB & Xero Payroll Course – Set up your Company Details

- MYOB & Xero Payroll Course – Add your Payroll Bank Account

- MYOB & Xero Payroll Course – Set up your Payroll Liability and Expense accounts

- MYOB & Xero Payroll Course – Create Pay Calendars

- MYOB & Xero Payroll Course – Create Employee Cards

MYOB & Xero Payroll Course – Payroll Dashboard

- MYOB & Xero Payroll Course – Familiarise Yourself with the Pay Items

- MYOB & Xero Payroll Course – Allowances, Termination Payment, Ordinary Hours, Overtime hours and more

- MYOB & Xero Payroll Course – Deductions, Reimbursements and Leave Categories

- MYOB & Xero Payroll Course – FBT, Leave Payments, Post-Tax and Pre-Tax Deducations

- MYOB & Xero Payroll Course – Pay Templates

- MYOB & Xero Payroll Course – Information about the Superannuation Guarantee

- MYOB & Xero Payroll Course – Superannuation Types – Fixed, Percentage of Earnings or Statutory Rate

- MYOB & Xero Payroll Course – Setting Pay Periods

- MYOB & Xero Payroll Course – Perform a Pay Run

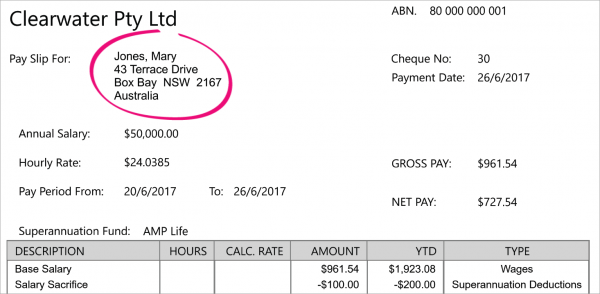

- MYOB & Xero Payroll Course – Print & Email Pay Slips to Employees

- MYOB & Xero Payroll Course – Pay Runs & Payroll Activity Reports

- MYOB & Xero Payroll Course – Suggestions/Recommendations

- MYOB & Xero Payroll Course – Create a Card for a New Company Employee

- MYOB & Xero Payroll Course – Create a New Account

- MYOB & Xero Payroll Course – Create a New Pay Item

- MYOB & Xero Payroll Course – Update Employee Payroll Details & Perform Pay Runs

- MYOB & Xero Payroll Course – Edit a Pay Run

MYOB & Xero Payroll Reporting Course

- MYOB & Xero Payroll Course – Print a Payroll Activity Summary Report

- MYOB & Xero Payroll Course – Print a Payroll Employee Summary

- MYOB & Xero Payroll Course – Reconcile Superannuation & Wages

- MYOB & Xero Payroll Course – Reconcile the PAYG Taxes

- MYOB & Xero Payroll Course – Reconcile Liabilities to Balance Sheet

EOY MYOB & Xero Payroll Procedures

- MYOB & Xero Payroll Course – Create EMPDUPE

- MYOB & Xero Payroll Course – Print out the Payment Summaries

MYOB & Xero Payroll Course – Employer Obligation Information

- Differences between full-time, part-time and casual employees

- Salary Sacrificing

- Employer Obligations relating to Super

- Employee Eligibility Criteria for Superannuation

- Pay Slip Requirements

- TFN Declaration Forms

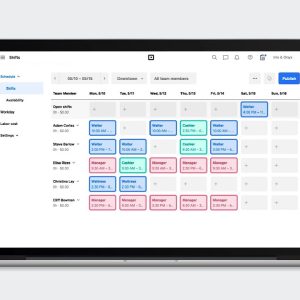

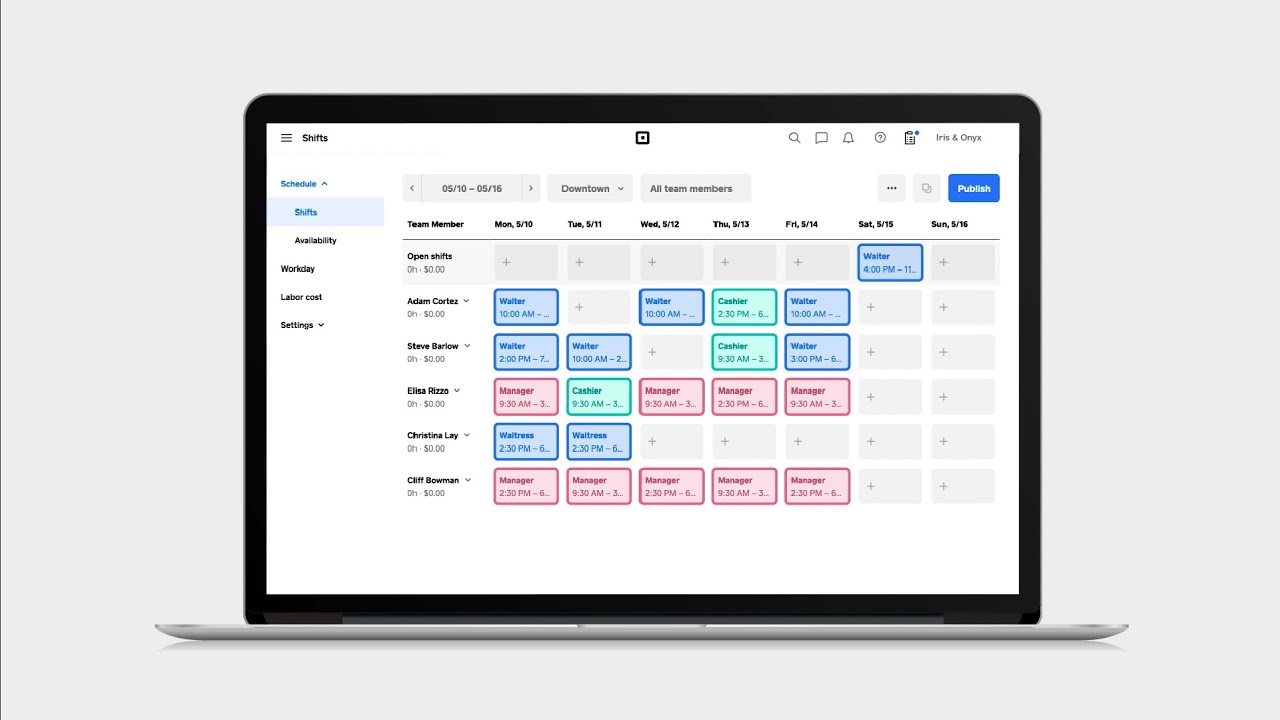

Human Resources Course – Rosters and Timesheets

When you’ve mastered the payroll administration tasks that staff perform every week you can learn about the popular integrations and apps that make life easier to manage staff rosters, schedules, sick days, leave and other payroll tasks.

When you’ve mastered the payroll administration tasks that staff perform every week you can learn about the popular integrations and apps that make life easier to manage staff rosters, schedules, sick days, leave and other payroll tasks.

Learn how to use Deputy, KeyPay, QuickBooks Time (was TSheets) and Square Team.

Getting Set Up

- Creating a business and customise settings

- Customise departments

- Set up roster defaults

- Add employees

- Invite employees

- Setup pay details

Create and Modify Rosters

- Create a roster

- View your roster in a calendar format

- Set repeating rosters

- Quickly copy roster details to new dates

Notify Staff & Self Management

- Notify staff of new rosters

- Time clock apps

- Time clock authentication options

- See who is in attendance

- Record Attendance

- Clock out

Learn more about the Rosters and Timesheets Training Course

Nationally Accredited Payroll Administration Qualification

Combine the above skills with the Nationally Accredited FNSTPB412 – Establish and maintain payroll systems

This unit describes the skills and knowledge required to record and prepare payroll documentation, respond to enquiries, and process payroll data for computerised systems.

This unit describes the skills and knowledge required to record and prepare payroll documentation, respond to enquiries, and process payroll data for computerised systems.

The unit applies to individuals and Business Activity Statement (BAS) agents, who use a range of organisational and other specialist techniques to manage payroll systems. They may work directly for organisations or be small business owners, contractors or service providers.

Work functions in the occupational areas where this unit may be used are subject to regulatory requirements. This unit is designed to meet the education requirements of the Tax Practitioners Board (TPB). Users are advised to check with the relevant regulatory authorities to confirm those requirements.

Elements and Performance Criteria

| ELEMENT | PERFORMANCE CRITERIA |

| Elements describe the essential outcomes. | Performance criteria describe the performance needed to demonstrate achievement of the element. |

| 1. Establish payroll requirements | 1.1 Assess scope of payroll services that a BAS agent can provide, and identify need for independent expert advice1.2 Apply knowledge of legislation in relation to National Employment Standards, and legislative requirements in regard to payroll payments1.3 Research and identify relevant state and modern awards, and employment agreements required for establishing a payroll system for individual employees1.4 Document the application and implementation of an organisation’s payroll reporting requirements through Single Touch Payroll according to statutory requirements |

| 2. Record payroll data | 2.1 Configure payroll system with complete data provided by employee and employer2.2 Review payroll data, identify discrepancies, and determine resolution procedure according to organisational policies and procedures2.3 Enter employee pay period details in payroll system according to source data |

| 3. Prepare and process payroll | 3.1 Conduct payroll preparation within designated timeframes and according to organisational policies and procedures3.2 Identify legislative and organisational requirements relevant to employment termination processes and payment and identify procedures for specialist review prior to payment3.3 Calculate and record payroll using employee source data according to legislative requirements3.4 Reconcile total payments for pay period, and review and correct irregularities according to organisational policies and procedures3.5 Make arrangements for individuals’ payments according to organisational authorisation policies and procedures3.6 Observe methodology of preparing an individual’s pay advice for distribution according to organisational and legislative requirements3.7 Generate, review and store payroll records according to organisational, security procedures and statutory requirements |

| 4. Handle payroll enquiries | 4.1 Respond to payroll enquiries and provide information according to organisational policies and procedures, and legislative and regulatory requirements4.2 Refer enquiries outside area of responsibility and knowledge to designated persons for resolution |

| 5. Maintain payroll | 5.1 Identify record keeping requirements relating to payroll according to current legislative and regulatory requirements5.2 Prepare and reconcile month-end and year-end payroll records5.3 Update records and systems according to salary reviews and other changes in employment status5.4 Generate payroll reports according to organisational policies and procedures |

Range of Conditions

This section specifies different work environments and conditions that may affect performance. Essential operating conditions that may be present (depending on the work situation, needs of the candidate, accessibility of the item, and local industry and regional contexts) are included.

| Payroll preparation must include: | calculating gross paycalculating net paypreparing pay advice slipspreparing paymentscalculating superannuation, leave entitlements, taxation and other deductions. |

| Payroll records must include: | electronic funds transferemployee summary reportend of month reportsend of year reportspay advice slipspayroll reporting, including year-end reconciliationstaxation reportstermination payments. |