Our Xero Online Training Package

Financials made easy with Xero — from Set Up to Payroll

WE OFFER A WHOLE SUITE of Xero online training courses in one neat package. If you are starting out or upgrading your business technology that get some digital marketing training as well in our StartUp Academy Cloud Package.

FOLLOWING is a summary of topics included in our Xero Online Training Package:

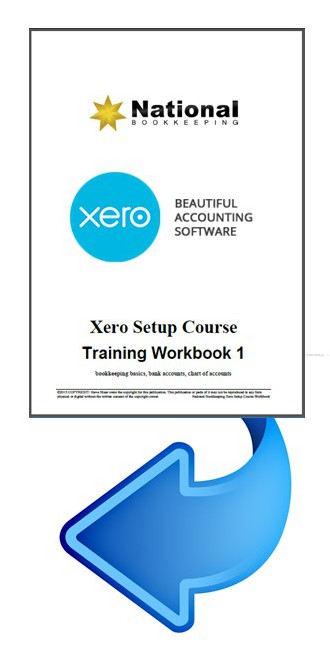

1. Xero Set Up Course

To start with we go through our DIY Bookkeeping knowledge to help you understand the most important aspects of what is important to know about bookkeeping and the accounting and financial aspects of what small business owners need to manage, including:

Charts of Accounts, Tax Codes, Cash Vs. Accrual Accounting Methods, Debits-Credits-Income-Expenses and an introduction to Credit Control.

Then we take a look at the various parts of the software where we need to perform a once of setup so that we can start to use the software to manage a business, including:

- introduction to navigating the Xero Accounting Software

- how to access and use the Free Software Trial

- setting up the organisational settings

- financial settings

- invoice settings and users

- Chart of Accounts

- account balances

- default invoice settings and email settings

- the dashboard watchlist and how to add a new contact

- adding multiple bank/credit card accounts

- adding PayPal accounts to receive credit card payments and

- how to manage bank accounts from the Dashboard.

Get the FREE Xero Setup Training Course guide

2. Xero Daily Transactions & Entries

In the Xero Daily Transactions Course you will learn about the different dashboards for various parts of the Xero software. You will learn your way around the main screen dashboard, as well as your Sales and Purchases Dashboards.

Learn:

- how to send or issue invoices to one customer or many customers at the one time, to save a repeating invoice and much much more

- how to work with credit notes: these could not be simpler when using Xero; you won’t get confused with them and they take seconds to generate, just like a sales invoice

- how to manage payables which happens at the purchase dashboard. Schedule payments, create bulk payments and ABA files, send suppliers a remittance, as well as process employee expense claims.

The Xero Daily Transactions Course includes training on:

- Entering Sales Invoices and Receiving Customer Payments

- Entering Supplier Invoices and Entering Supplier Payments

- Transferring Money Between Accounts

- Adding New Contacts

- Edit existing Contacts and Coping with Duplicate Contacts

- Navigating the Sales Dashboard

- Entering Credit Note and Allocating them to invoices

- Emailing or Printing Invoices

- Entering a New Purchase Order

- Sending a Purchase Order

- Deleting Invoices

- Voiding Invoices, Voiding Invoices when payments are applied

- Internal Bank Transfers

- Handling Overpayments

- Processing Contra Deals

- Create a Quote in Xero.

Credit & Debt Management

Late Payments and Time Spent Unproductively

Not every business suffering cash flow problems goes insolvent right away. Many more, especially those operated by sole traders, struggle on with clients and customers who don’t pay on time or, worse, not at all.

A study commissioned by PayPal and QuickBooks Intuit, found that Australian small businesses are owed a collective $26 million in unpaid invoices. That’s roughly $13,200 owed to each business at any given time, for which business owners will spend an average of 12 days chasing each year.

Credit and Debt Management Training

3. Xero Journal Entries and Bank Reconciliation

We explore a bank statement and enter data for that period as well as the direct debit transactions that aren’t entered as part of the Daily Transactions.

You’ll learn about ad hoc payments for director wages, as well as a capital purchase of a vehicle and depreciation of that vehicle, plus alternatives like leasing or second hand car purchase under $20,000.

You’ll perform a bank reconciliation that doesn’t balance and then go through the entries to sort out the issues and mis-typing that happens in most businesses.

- Entering and coding direct debits

- Interest payments and charges

- Coding capital purchases

- Understanding depreciation

- International credit card payments and charges

- Basic Payroll entries for micro businesses

- Loans to and from the company

- Experience a bank rec which doesn’t balance

- Rectify entries to complete the bank reconciliation process.

Online Training Courses & Support

These courses are delivered and supported online so you can enrol now and learn at your own pace with support from the National Bookkeeping central Support HQ team at 123 Group Pty Ltd.

Training is available as short separate courses, training manuals with practical exercises or even one-on-one training to solve your own particular issues.

The Xero PRO Course is suitable for business owners and managers, job seekers, students who are transitioning from different careers and university graduates who want practical training in how to use Xero in small business.

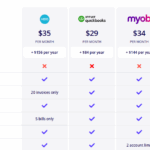

We also offer courses in MYOB and QuickBooks Online.

4. Xero Reporting Course

Fundamental Financial Reporting in Xero’ is currently included in the Xero Daily Transactions Course and includes an introduction to reports as well as how to get the Balance Sheet (Assets and Liabilities), Profit and Loss (income and expenses) and reporting for Fixed Assets with some creating or modifying your Chart of Accounts.

5. Xero GST, Reporting & BAS Course

In this course you about transactions that make GST and BAS reporting tricky, including purchases which are GST-free, those which have partial GST, or are international payments. You’ll also learn about transactions with varying GST percentages and how you can use a spreadsheet to calculate your PAYG & Super obligations and then just code them into your Xero software. These topics are included in this course:

- GST treatment for capital purchases (a vehicle)

- How different costs of running a vehicle are treated

- When FBT applies to expenses like entertainment

- Introduction to Payroll & how wages are treated in the BAS

- Financial Settings with regard to the GST registration (Cash vs Accrual and quarterly vs monthly)

- Run a BAS report, which is combined with our specially-designed “Ad Hoc Payroll” Excel spreadsheet case study calculations in order to work out the final liabilitie,

- See the financial results of the business owners ‘change of strategy’ and focus

- You’ll see what these results look like at the end of the quarter, as well as month-by-month comparisons of Profit and Loss and Balance Sheet reports

- How the business owner can use the information in the reports to change the direction of the business

- Configure their software to obtain even better reports at the end of the next quarterly reporting period.

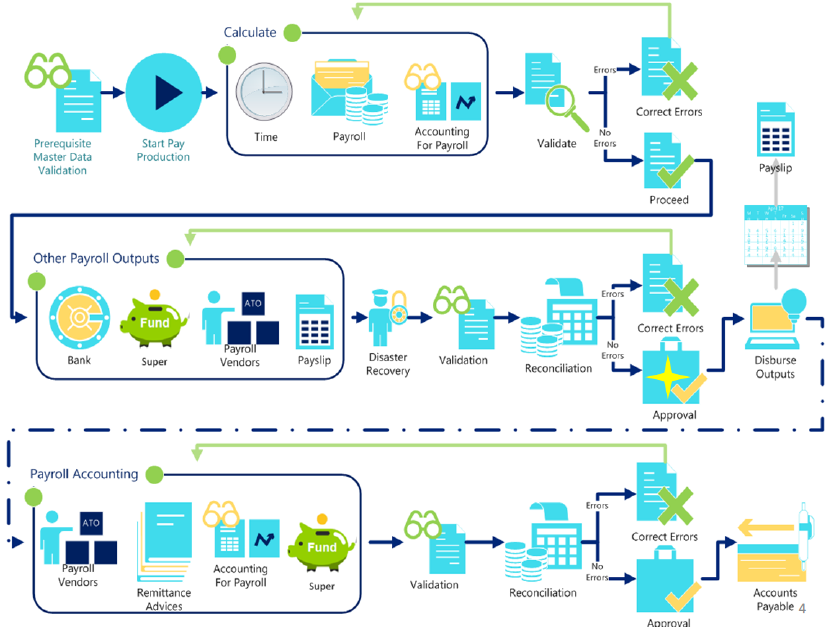

6. Xero Payroll Course

These videos below will aid and assist you to get your payroll users and settings correctly set up so then you can start adding employees and processing pay runs. We show you how to set up your linked accounts, take you for a look at the individual pay and line items and also how to add a new (or various) payroll calendars.

This Xero course includes:

- Setting our user permissions

- Linked Account Set Up

- Payslips Set Up

- Pay Items Set Up

- Calendar, Payroll Settings and Superannuation Setup

- Employee Details

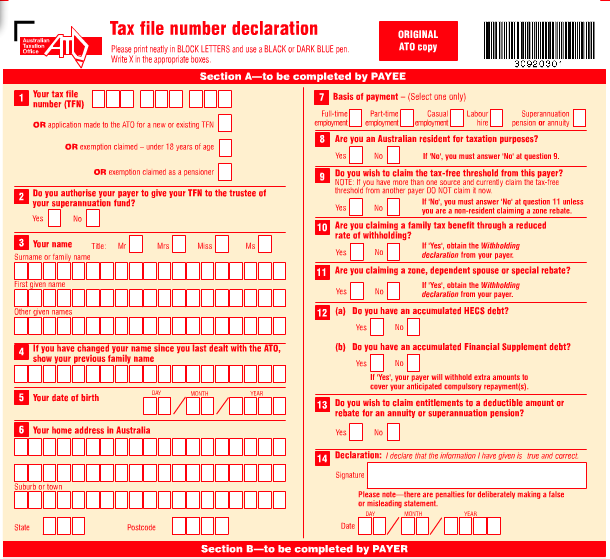

- Tax Declarations

- Leave

- Bank Accounts, Pay Templates.

7. Xero Cashflow, ROI and Strategy Course

You explore the typical overspending that some new entrepreneurs go through, and understand how these transactions affect the cashflow of a business. You’ll learn about the financing, operational and investment aspects of a cashflow statement and about alternative strategies that a business can take regarding its spending and credit risk management.

You’ll go through other Credit Management reports like Aged Receivables and understand the tools available to small businesses to reign in their accounts receivable, get money into their bank accounts quicker and use their accounting software to help perform better marketing and operational management by budgeting and understanding their Return On Investment.

We explore some business opportunities in this workbook that relate to ways that corporate employees can become small business owners and consultants in their local area with the use of cloud accounting software.

- Changing a Business Name

- Subscribing to HiPages (HomeImprovementPages.com.au) and using it as a lead source for trades

- Real Estate Agents Course and setting up a real estate agency

- How to earn money selling software training courses – including creating quotes, invoice and receiving payments

- Advertising on LinkedIn to find a real estate agent employee

- Setting up a PROFESSIONAL WordPress website

- Explore strategies to GET REGULAR WORK

- Using car trailers as an advertising medium

- LOAN & purchase transactions for a CUBBY HOLE commercial warehouse

- Home Improvement Pages as a marketing lead source for trades

- Make changes to inventory items

- Creating invoices for Sales & Marketing contract work

- Importing bank statements to save on data entry

- Creating bank rules

- Matching transactions for Bank Statements from Bank file

- Creating transactions for BAS refunds

- Accounting for MOTOR VEHICLE DEPRECIATION

- Accounting for Commercial Premises DEPRECIATION

- PAYG & Superannuation

- Cash flow statements

- Setting budgets

- Return on Investment Analysis