Description

Xero Setup and Configuration

To start with we go through our DIY Bookkeeping knowledge to help you understand the most important aspects of what is important to know about bookkeeping and the accounting and financial aspects of what small business owners need to manage, including:

Xero Beginners Online Training Course

These fundamental Xero accounting skills will enable you to perform most of the tasks required in a junior or office and accounts assistant role in most organisations. It includes daily and weekly tasks like data entry of purchases and sales and credit management to keep track of what money is owed and owing. End of month task training is also included to help you reconcile your data entry to the actual bank statement so you can produce accurate end of month reports.

Xero Reporting Course

Fundamental Financial Reporting in Xero’ is currently included in the Xero Daily Transactions Course and includes an introduction to reports as well as how to get the Balance Sheet (Assets and Liabilities), Profit and Loss (income and expenses) and reporting for Fixed Assets with some creating or modifying your Chart of Accounts.

Xero GST, Reporting & BAS Course

In this course you about transactions that make GST and BAS reporting tricky, including purchases which are GST-free, those which have partial GST, or are international payments. You’ll also learn about transactions with varying GST percentages and how you can use a spreadsheet to calculate your PAYG & Super obligations and then just code them into your Xero software.

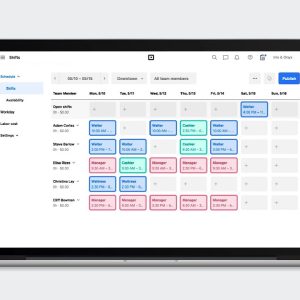

Xero Payroll Course

These videos below will aid and assist you to get your payroll users and settings correctly set up so then you can start adding employees and processing pay runs. We show you how to set up your linked accounts, take you for a look at the individual pay and line items and also how to add a new (or various) payroll calendars.

Xero Cashflow, ROI and Strategy Course

You explore the typical overspending that some new entrepreneurs go through, and understand how these transactions affect the cashflow of a business. You’ll learn about the financing, operational and investment aspects of a cashflow statement and about alternative strategies that a business can take regarding its spending and credit risk management.

Industry Connect

Complete accounting and bookkeeping assignments and discuss your results with practising bookkeepers and accountants. This training options gets you in contact with bookkeeping businesses who can provide practical guidance on your job hunting journey. Gain some insights into what potential employers are looking for.