Beginners to Advanced Certificate Courses in Xero, MYOB and QuickBooks Online

Payroll is an important part of every business and often contributes to 30% of the total expenses for an organisation. Companies use numerous programs to Hire and Manage their staff and more and more of these functions are available with the payroll software you use every day.

QuickBooks Online, MYOB and Xero all own HR Management software and the more you know about how to use your accounting software the better you can manage a business.

These are topics which are important to learn when applying for work or managing tasks in the role of an office administrator or payroll officer.

Payroll Training Courses

Cloud-based accounting software is always up-to-date so PAYG tables and other information like Superannuation percentages are included with the software with no need to go through an updating/upgrading process.

The downside for micro businesses is that you can’t just buy the software once and keep using it for basic bookkeeping tasks like quoting, invoicing and purchases.

There are many benefits of Cloud-based accounting software and one is that bookkeepers/accountants can perform Payroll processing tasks from anywhere.

These payroll training courses are ideal for:

- Job seekers

- Business owners & office admin staff

- Junior accounts staff who want career progression

Get the FREE Payroll Administration Introduction Training Course manual

Learn about the fundamental aspects of payroll administration, including:

- Setting up employee details, including awards, rates and taxes

- Understand how Single Touch Payroll works

- Entering timesheet data

- Performing pay runs and providing pay slips

Use this enquiry form to get the Advanced Certificate in Payroll Training Course Collection for over 60% OFF the price – when you enquire through Australian Small Business Centre!

Payroll Setup Training Course Topics

Payroll Training Course – Company Settings

- Payroll Course – Create a New Company File

- Payroll Course – Set up your Company Details

- Payroll Course – Add your Payroll Bank Account

- Payroll Course – Set up your Payroll Liability and Expense accounts

- Payroll Course – Create Pay Calendars

- Payroll Course – Create Employee Cards

Payroll Training Course – User Settings

- Payroll Setup Course – Setting our user permissions

- Payroll Setup Course – Payroll Settings – Linked Account Setup

- Payroll Setup Course – Payroll Settings – Payslips Setup

- Payroll Setup Course – Payroll Settings – Pay Items Setup

- Payroll Setup Course – Payroll Settings – Calendar Setup

- Payroll Setup Course – Payroll Settings – Super Setup

Payroll Employee Details Training Course Topics

Payroll Training Course – Employee Details

- Payroll Course – Employees – Details

- Payroll Course – Employees – Employment

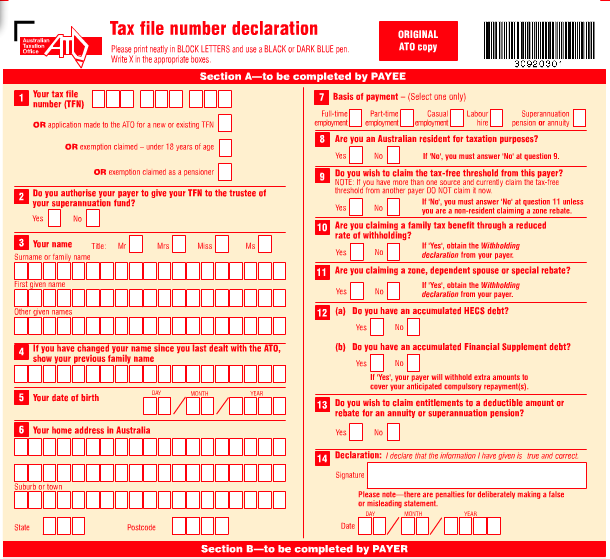

- Payroll Course – Employees – Tax Declaration

- Payroll Course – Employees – Leave

- Payroll Course – Employees – Bank Accounts

- Payroll Course – Employees – Pay Template

- Payroll Course – Employees – Opening Balances

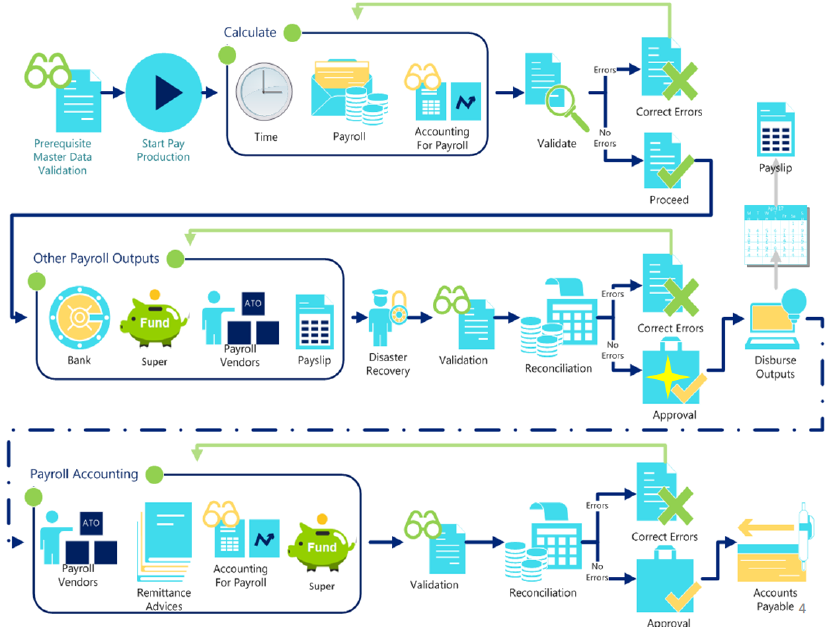

Payroll Training Course – Processing Pays

- Payroll Course – Time Sheets – Entering Time Sheet Information

- Payroll Course – Pay Runs – Posting a simple pay run

- Payroll Course – Pay Runs – Pay Run Options

Payroll Training Course – Practical Tasks

- Payroll Course – Familiarise Yourself with the Pay Items

- Payroll Course – Allowances, Termination Payment, Ordinary Hours, Overtime hours and more

- Payroll Course – Deductions, Reimbursements and Leave Categories

- Payroll Course – FBT, Leave Payments, Post-Tax and Pre-Tax Deducations

- Payroll Course – Pay Templates

- Payroll Course – Information about the Superannuation Guarantee

- Payroll Course – Superannuation Types – Fixed, Percentage of Earnings or Statutory Rate

- Payroll Course – Setting Pay Periods

- Payroll Course – Perform a Pay Run

- Payroll Course – Print & Email Pay Slips to Employees

- Payroll Course – Pay Runs & Payroll Activity Reports

- Payroll Course – Suggestions/Recommendations

- Payroll Course – Create a Card for a New Company Employee

- Payroll Course – Create a New Account

- Payroll Course – Create a New Pay Item

- Payroll Course – Update Employee Payroll Details & Perform Pay Runs

- Payroll Course – Edit a Pay Run

Payroll Reporting Training Course

- Payroll Course – Print a Payroll Activity Summary Report

- Payroll Course – Print a Payroll Employee Summary

- Payroll Course – Reconcile Superannuation & Wages

- Payroll Course – Reconcile the PAYG Taxes

- Payroll Course – Reconcile Liabilities to Balance Sheet

Payroll EOY Procedures Training Course

- Payroll Course – Create EMPDUPE

- Payroll Course – Print out the Payment Summaries

Advanced Certificate Payroll Course – Employer Obligation Information

- Differences between full-time, part-time and casual employees

- Salary Sacrificing

- Employer Obligations relating to Super

- Employee Eligibility Criteria for Superannuation

- Pay Slip Requirements

- TFN Declaration Forms

Professional Xero Course for Small Businesses

If you are a small business owner or manager the Xero Pro course will give you training on almost every aspect of managing your business accounts.

Beginners Certificate Xero Courses include tasks that most office admin or reception staff perform every day, week and at the end of each month.

The Advanced Xero Course includes GST, Financial Reporting, Payroll and Cashflow Management – all of this is included in Xero Pro Course.

Advanced Certificate Payroll Training Course

- Payroll Administration Course – Set up Time Sheet Preferences

- Payroll Administration Course – Edit an Existing Super Payroll Category

- Payroll Administration Course – Create a New Super Payroll Category

- Payroll Administration Course – Add a New Payroll Category

- Payroll Administration Course – Edit Employment Classifications to Suit the Business

- Payroll Administration Course – Create a Casual Employee

- Payroll Administration Course – Create Permanent Employees

- Payroll Administration Course – Enter Time Sheets

- Payroll Administration Course – Process a Pay Run

- Payroll Administration Course – Import Time Sheets

- Payroll Administration Course – Process Payroll with Personal Leave included

- Payroll Administration Course – Create a New Deduction Payroll Category

- Payroll Administration Course – View Employee Leave Accrued

- Payroll Administration Course – Process Pay including Annual Leave

- Payroll Administration Course – Run a Payroll Entitlements Report

- Payroll Administration Course – Run a Payroll Journal Report

- Payroll Administration Course – Produce a Balance Sheet

- Payroll Administration Course – Record your Bank Details

- Payroll Administration Course – Record Employee Bank Details

- Payroll Administration Course – Process a Pay Run

- Payroll Administration Course – Create an Electronic Payment File

- Payroll Administration Course – Process Final Pay

- Payroll Administration Course – Update Employee Card File

Payroll Software and HR Integrations

The biggest advantage for online, cloud-based accounting and payroll software is the ability to “integrate” with many other apps and systems that each perform very specific tasks.

Intuit (QuickBooks) and Xero are well known for buying up some of the software integration programs that link with them, including TSheets (Intuit) and Planday (Xero).

MYOB is owned by an US private equity company and are continuously trying to combine their MYOB AccountRight and MYOB Essentials software into one main login interface. MYOB Essentials is their online-accounting version and has a similar number of integrations to Xero and QuickBooks Online.

Use this enquiry form to get the Advanced Certificate in Payroll Training Course Collection for over 60% OFF the price – when you enquire through Australian Small Business Centre!