Description

Goals and Strategies

A BUSINESS PLAN is simply as the name implies — a plan about your business. As you write down your goals, strategies and action steps, your business becomes real. We show you how.

IT’S USED TO LOOK AHEAD, allocate resources, focus on key points and prepare for problems and opportunities. But (believe it or not) many business owners find formulating a Business Plan terribly daunting and avoid it altogether.

Be one step ahead from the get-go — not only will having a plan for your business help you get to market faster, it also helps you gain clarity, focus and confidence. It outlines exactly what your business is going to do, and for whom, and what sets you apart from your rivals.

Forecasts and Assumptions

Banks, investors and other lending institutions will insist on a well-written, concise Business Plan on which to base their funding or investing decisions and if you can provide the numbers and those numbers stack up, then you’ll start from a point of certainty.

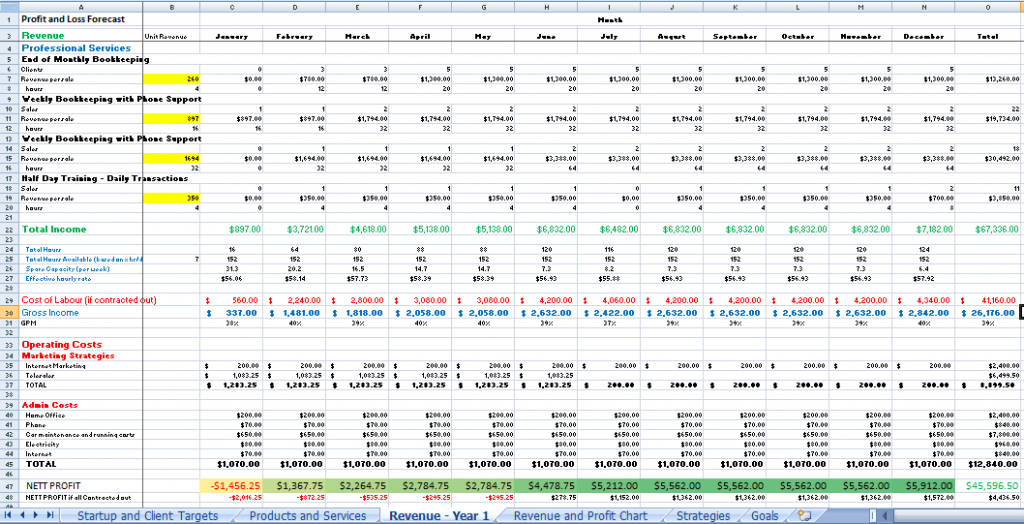

When you combine your ideas and concepts from subject 1 into a spreadsheet that clearly demonstrates and justifies the potential revenue and profit from a business it will give potential investors confidence but the most important thing is that YOU believe you can do it. This course combines:

- Ideas for packaging products and services

- Justifiable retail pricing

- revenue that increases as you grow your business

- grouping of revenue, cost of goods, marketing and operational costs

- key financial performance indicators and percentages

- the basis for regular reporting to test and measure

Starting simply with key information

Don’t be Intimidated. Goals and strategies can often be written briefly and succinctly in a couple of pages and once complete it can remain dynamic and ever-changing with small modifications as your business changes.

Don’t be Intimidated. Goals and strategies can often be written briefly and succinctly in a couple of pages and once complete it can remain dynamic and ever-changing with small modifications as your business changes.

Although many business plans are Word documents they can also be Excel spreadsheets which clearly show the main information, key assumptions and calculations and demonstrate just how easy it is to achieve your goals.

A completed spreadsheet is included in the course that shows how you can startup a bookkeeping (or other services) business and having it running smoothly within 6 months with low initial investment.

Business Plans should be revised throughout the life of your business.

Getting off to a great start

We will walk you through the elements of a Business Plan:

- Learn how to conduct cash flow forecasts, profit and loss projections, likely return on investment and set pricing strategies and profit targets

- Learn how to develop the clear goals you need to focus on as a measure of your business performance.

- Identifying methods of promoting your business.

- Understand strategies to achieve lower costs of production and distribution than your competitors, and turn your business into a class leader in your industry

- Identify the staffing requirements to effectively deliver your product or service.

- Develop risk management strategies according to the goals and objectives of your business, and a contingency plan to address possible areas of non-conformance with the Business Plan.

What You’ll Learn

This module gives you the understanding of how to create (and modify) your business plan using Microsoft Excel and use the spreadsheet to understand how your business is performing on a monthly basis and use this information to forecast future revenues.

Where you want to go with your business (setting up goals and strategies to make them happen) and finally how you are going to get there( infrastructure needed, legal obligations, marketing and systems management as well as 2 years minimum financials).

You will learn what information goes where, so that there is a logical progression of that information. That will make your final plan both easy to understand and easy to manage as your business takes shape.

Be aware that:

- Should you require capital (money) to start or support your business, you will need to produce evidence of viability in the form of a well- structured, well researched and well documented business plan. All banks, investor, banks, and other funding bodies will require one.

- Learn more about our course on Valuation and Raising Capital

The Career Academy pathway to Nationally accredited training

After completing the pre-accredited online short course students can either go into business for themselves or explore options to complete a nationally accredited qualification and receive a Nationally recognised certificate.

Elements and Performance Criteria

|

ELEMENT |

PERFORMANCE CRITERIA |

|

Elements describe the essential outcomes. |

Performance criteria describe the performance needed to demonstrate achievement of the element. |

|

1. Identify costs, calculate prices and prepare profit statement |

1.1 Identify and document costs associated with production and delivery of business products and services 1.2 Calculate prices based on costs and profit margin, as an hourly charge-out rate for labour or unit price for products 1.3 Calculate break-even sales point to establish business viability and profit margins 1.4 Identify appropriate pricing strategies in relation to market conditions to meet business profit targets 1.5 Prepare projected profit statement to supplement the business plan |

|

2. Develop a financial plan |

2.1 Set profit targets or goals to reflect owner’s desired returns 2.2 Identify working capital requirements necessary to attain profit projections 2.3 Identify non-current asset requirements and consider alternative asset management strategies 2.4 Prepare cash flow projections to enable business operation in accordance with business plan and legal requirements 2.5 Identify capital investment requirements accurately for each operational period 2.6 Select budget targets to enable ongoing monitoring of financial performance |

|

3. Acquire finance |

3.1 Identify start-up and ongoing financial requirements according to financial plan/budget 3.2 Identify sources of finance, including potential financial backers, to provide required liquidity for the business to complement business goals and objectives 3.3 Investigate cost of securing finance on optimal terms 3.4 Identify strategies to obtain finance as required to ensure financial viability of the business |

These are the requirements of the BSBSMB402 – Plan small business finances accredited training package