Banks will automatically lend money for some shares

Margin Lending is the official term for lending money to buy shares. The interest rates are generally higher than home investment and home living loans because shares are seen as riskier than property but there are always varying levels of risk for both categories. The market value of properties are assessed manually by the bank before each loan application but shares are bought and sold on a live exchange so they are valued automatically by the market yet despite this banks have different lending ratios for each different company, why? It’s about credit risk.

Margin Lending is the official term for lending money to buy shares. The interest rates are generally higher than home investment and home living loans because shares are seen as riskier than property but there are always varying levels of risk for both categories. The market value of properties are assessed manually by the bank before each loan application but shares are bought and sold on a live exchange so they are valued automatically by the market yet despite this banks have different lending ratios for each different company, why? It’s about credit risk.

Ratings Agencies and Credit Risk for organisations

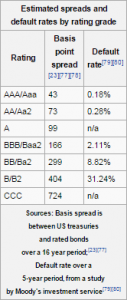

Credit Rating Agencies (CRA’s) like Standards and Poors, Moody’s and Fitch evaluate most aspects of a company’s credit worthiness and then issue a credit rating that reflects it – they do the same for other entities that borrow money like countries and local councils. An example of a credit rating is AAA, Aa, A, BBB and you can read more about these ratings and how they are measured at Wikipedia. The image on the right gives you an idea of how credit risk is managed.

Credit Risk for individuals

Credit risk for individuals applies to businesses that operate under a sole trader structure and one of the best ways to measure this risk is with that persons CRA (Credit Risk Assessment). A very common measurement is a VEDA score, but be aware that this score is assembled by a company (Veda) from information it gathers (with your permission) about loan applications, loan rejections, loans, loan risks, defaults etc.

Loan to Value Ratios (LVR)

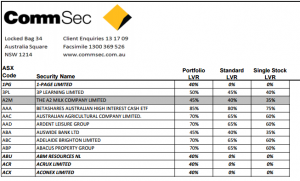

With some fundamental information about how businesses are valued and their credit risk evaluated and published you can begin to understand the LVR’s that large stockbroking firms like Comsec allocate to each company. Comsec publish regular updates on these LVR’s as new information becomes available from publich announcements and other official sources. You can see from the Accepted_Shares_Comsec_Margin_Lending_December_2015 that Comsec are willing to lend between 55-65% of the value of Veda shares.

With some fundamental information about how businesses are valued and their credit risk evaluated and published you can begin to understand the LVR’s that large stockbroking firms like Comsec allocate to each company. Comsec publish regular updates on these LVR’s as new information becomes available from publich announcements and other official sources. You can see from the Accepted_Shares_Comsec_Margin_Lending_December_2015 that Comsec are willing to lend between 55-65% of the value of Veda shares.

If you are willing to put down up to $4,500 for $10,000 worth of Veda shares then Comsec will lend you the rest as part of a margin lending facility (see he attachment for confirmation and check the Comsec for the current accepted shares if you are serious about investing).

How much are you willing to invest in your own business?

When you understand how credit risk and lending criteria work you’ll have a more realistic expectation about your capabilities of attaining a loan for your business. The one thing you can do is to start by using your own money and they call that Bootstrapping.

Free Raising Capital Email Course