Will the share price and value of SEEK change because of their competitors?

SEEK has many competitors including Gumtree

We spoke to a new business in Chatswood that used Seek to look for a sales rep as well as some office bound telemarketers and support staff and they discovered an interesting pattern about SEEK ads: they last for 2-3 days and then job applications evaporate.

So where do these jobs ads go and is SEEK the best way to find employees for your business?

This company then thought about spending more money to “feature” their SEEK job ad after the initial week to get back towards the top of the list but after doing a search to try to find their SEEK AD they thought there must be a better way. They searched GOOGLE for job ads that use their keywords and noticed that a plethora of other job ads appeared – job ads from smaller less known advertising sites.

After coming to the conclusion that SEEK may not be the best place to advertise their positions vacant, they decided to look into these other websites and we’ll reveal the results of their activity over the coming weeks.

Everyone Needs to be Aware of Competition!

Finding team members is a very important part of

managing your business and you can do it by finding independent contractors, casual workers or full-time employees. Using a well known job advertisement site is one way, but there are many more that might give you a much better result.

Have you ever thought that people think about YOUR business the same way?

We are currently developing content for a new section of our small business course about

valuations and raising capital and this is a great chance to point out some information for you about how a “publicly listed” company like SEEK is valued. Being a public company they are required by ASX to disclose any information that will materially affect their business very soon after they discover it – they call this disclosure – and it is a great way to learn about your industry when doing your own

market research.

You can see all the information about

SEEK’s shares at the official ASX website and if you scroll down about half way you’ll notice that their share price is currently in “bear” territory – investors think the price is too high for the company’s future earning prospects so the price is going down.

Share price and Value are two different measurements

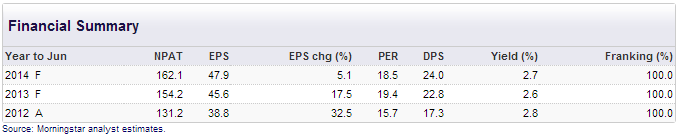

Share price is one thing, but how the share price relates to how much money the company makes (profit) is another thing and the information under the heading “Financial Summary” at this website gives you (investors) a better idea of “value”. You can see the Price to Earnings Ratio (PER) and you might find one thing particularly interesting – they compare the share price to “Actual” earnings as well as “Estimated” earnings.

Notice the Price to Earnings (PER) and Dividend Per Share (DPS) for SEEK (ASX:SEK)

Estimated earnings is something that every business has to try and work out when they create their business plan, so this information might provide you with some comfort that small and large businesses are making educated guesses about how much money they are going to make every day!

If you ever have any doubt about starting your own business or if you ever doubt that you have the ability to forecast (ie. guess) how much money you’ll make, it’s sobering to realise that large businesses are doing this every month.

See if you can answer these simple questions:

- Are they forecasting increasing earnings?

- Are they paying more or less dividends in the next two (forecast) years?