Need to have a house to get a business loan to start a business?

Sometimes you need money to make money but sometimes you can bootstrap it (ie. use your own money or borrow money from family and friends). If you need to borrow money and get a business loan you need to understand that there is a cost for this money, on top of having to return it, and that’s normally calculated by an interest rate – the higher the risk, the higher the rate. Needless to say the big question for a potential lender is to find out how big a risk YOU are and how they can mitigate that risk (ie. reduce their risk).

Sometimes you need money to make money but sometimes you can bootstrap it (ie. use your own money or borrow money from family and friends). If you need to borrow money and get a business loan you need to understand that there is a cost for this money, on top of having to return it, and that’s normally calculated by an interest rate – the higher the risk, the higher the rate. Needless to say the big question for a potential lender is to find out how big a risk YOU are and how they can mitigate that risk (ie. reduce their risk).

Some business loans are offered to individuals if that person owns property, the property becomes the security against which the loan is made. These business loans are often made with a longer payback timeframe because the lender or bank has your property as security, but what if you don’t have a house or other property?

Can a business loan be based on another asset

If you don’t own property or at least enough of that property (ie. your equity in that property) then some lenders or banks will issue loans based on assets of the business or assets that the business want to purchase. This is often called asset-based lending and is common in manufacturing where the purchasing of a machine will result in that business making lots of products and selling them. Asset based finance also comes in the form or chattel loans, or financial or rental leases.

You need to be aware that in some circumstances the asset is not held in the business as an asset but as a liability that needs to be repaid so speak to your accountant about the best way to manage your business assets.

Can I get a business loan based on my cashflow?

If your business is new there may be no guarantee of future income so unless you have a patent on something that others have expressed an interest and need for then you may not be able to get cashflow finance for your business. If your business has been operating for some time and there is strong evidence of regular cashflow you may find it possible to find business loans based on your current sales activity.

Loans for Business StartUp Course

We’re excited to announce that on selected online courses we can offer interest free loans for business courses through EzyLearn. Conditions will apply and the funding will only be provided for selected courses but this is a great way to get skilled up and have the necessary tools to plan for success in your new business startup.

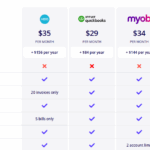

CURRENT OFFER

When you enrol into the EzyStartUp Course and choose all of the optional software courses (which are discounted when selected during the enrolment process) you’ll have the opportunity to pay a deposit and pay the balance off over 6 equal monthly payments. No setup fee and no interest charges. Here is the EzyStartup Course Enrolment Page.

When you enrol into the EzyStartUp Course and choose all of the optional software courses (which are discounted when selected during the enrolment process) you’ll have the opportunity to pay a deposit and pay the balance off over 6 equal monthly payments. No setup fee and no interest charges. Here is the EzyStartup Course Enrolment Page.

Free Valuation and Capital Raising Email Course

We’ve included some of the key elements of our Valuation and Raising Capital course in an easy to digest email course format – and it’s free so feel free to follow the button below, enter your details and start receiving valuable insights from our Academic Board.

Register for Free Valuation and Raising Capital Email Course Outline