HR is complex and job seekers go through a grueling, competitive process to become the chosen candidate at the end of the hiring funnel so you want to make sure that the onboarding is seamless.

The onboarding process is critical for your business because it can cost you money and time if not done well.

There are legal obligations relating to payroll administration as well as things you need to do to educate your new recruit about how your business operates.

Here we outline some of the obligations relating to what a payroll administrator does.

Single Touch Payroll Phase 2

Paying superannuation is a critical component of payroll and you need to ensure that your new recruits details are captured and that super is paid from the first pay run.

This is done using a Nomination Form where they get to enter the details of their superannuation fund.

Confirming Award and Pay Rates

Every employee is on an award that clearly defines their role, the amount of time they need to work and how much they get paid for this work.

If the job is a sales job or customer service you might also want to include some expected KPI’s so the staff member understands the expectations from the start. Some of these might include:

- 50 calls per week

- Solving 10 customer service support tickets a day

- Winning 10 new jobs per quarter

Employment Agreement

For administrative roles this agreement can be very uniform but it can vary from industry to industry and it is good for your business to have something to refer to. Typical clauses in an employment contract include:

- Position description

- Duties and obligations

- Reporting lines

- Hours of work and shift management

- Rate of pay

- Annual leave

- Medical obligations and qualifications

- Conduct and performance

- Intellectual property & Confidential information

- Work, Health and Safety

- Terminations and Restraint

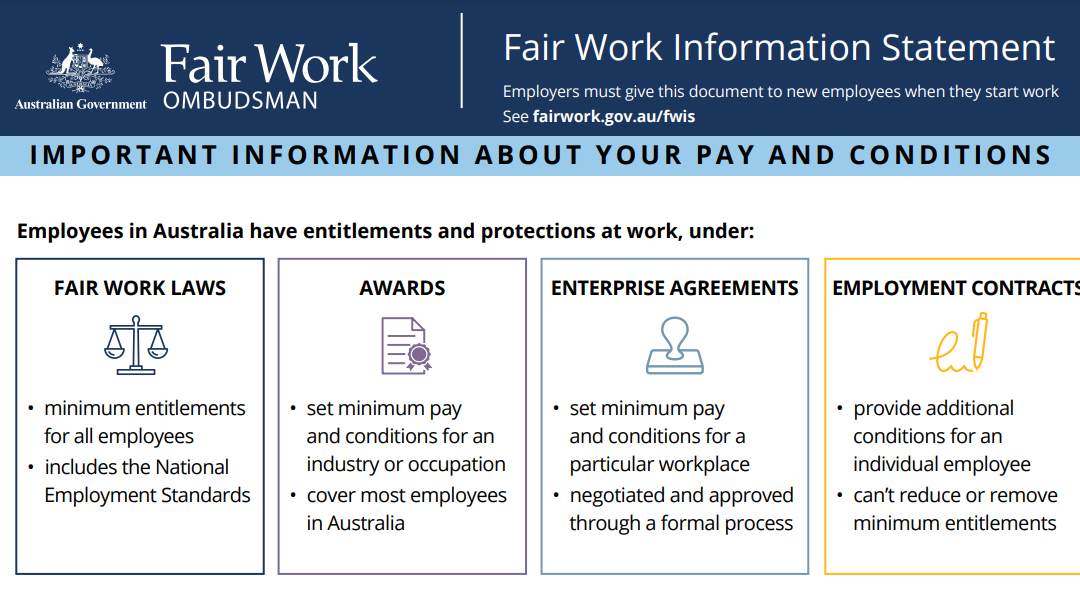

Fair Work Information Statement

This document outlines the entitlements and protections available to employees. This document covers information about awards, Agreements, employment contracts and Fair Work laws.

It highlights minimum wages and information about which government departments to contact if you need clarification or help with anything and it can be used by employees to ensure that the Employment Agreement and conditions are valid.

Next of Kin Information

You’re going to be spending a fair bit of your day at your employers office or locations or even in your car and on the road so it’s important that the company has your next of kin information in case something happens to you.

TFN Declaration Form

Your Tax File number identifies you in the Australian Taxation Office system and ensures that PAYG, Super and other information is accurate and up-to-date.

Start a career in Payroll with 123 Group Pty Ltd

With the help of the Australian Small Business Centre and National Bookkeeping you can up-skill in Payroll Administration, learn about popular integrations that help employers manage their staff and rosters and other aspects of payroll managers role.

Combined with Industry Connect and an online digital profile you can get discovered by local employers who need help with their payroll.

See the Advanced Certificate in Payroll Administration Course