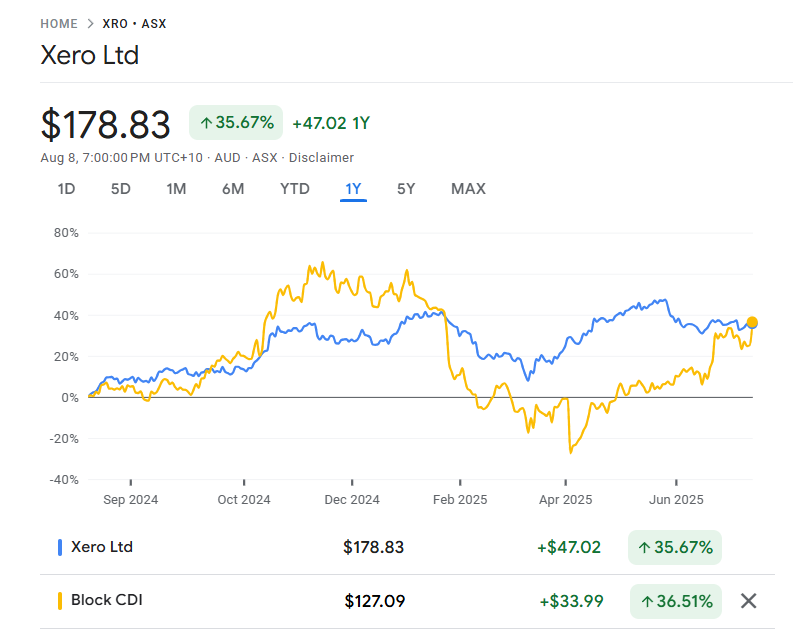

Xero is getting all sorts of bad publicity in recent years for its relentless annual increase in subscription fees. Comments are appearing on their Facebook ads and in online forums about the pain it is causing small businesses so we wanted to delve into an alternative software program that might suit some businesses, Square.

Square is owned by Block Inc who bought AfterPay.

Why Square Often Beats Xero for Micro Businesses in Australia

- Pricing Structure & Entry‑Level Costs

Square Invoices offers a free basic tier—no subscription required—which includes unlimited invoices, unlimited customers, and unlimited users - On the other hand, Xero’s Early (Starter) plan costs around AU $13/month (or more, depending on region), with strict limits: only 20 invoices, 5 bills, and 20 bank reconciliations per month

For micro enterprises that operate with low invoice volumes, Square delivers immediate value with virtually zero software cost. Xero’s low‑tier plan’s transaction caps can be hit quickly even by a solo tradesman or market stall, forcing an upgrade.

Invoicing & Daily Cash Flow Operations

Square Invoices scores extremely high on ease of use and invoice generation: automatic reminders, ability to schedule or save customers on file, future-charge options, and built-in support for recurring billing.

On G2, users rated overall ease-of-use 9.4/10 versus Xero’s 8.7, and recurring billing 8.9 vs Xero’s 8.3

Xero, with its broader accounting footprint, includes features for bills, expenses and tax—but for basic invoicing the interface can feel heavier and overpowered.

For businesses sending daily or weekly invoices—say a coach, consultant, or pop‑up food seller—Square’s minimal setup and intuitive interface mean faster execution, fewer mistakes, and reduced admin time.

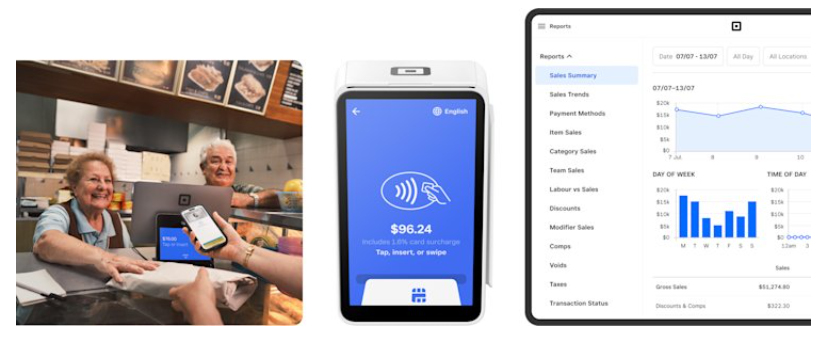

Point of Sale & Sales Integration

Square’s integrated Point of Sale system (for iOS/Android) connects directly to card readers and digital receipts, inventory tracking, and sales reports in real time—right out of the box

While Xero can integrate with Square via a third-party (Amaka) to generate daily summary invoices into Xero’s ledger, that integration requires setup. It imports a prior day’s summary and doesn’t offer the same native POS experience.

Square is a clear leader for retailers

If you’re a café, market stall, boutique or solo seller—Square lets you ring up sales instantly, track payments, and monitor inventory without juggling separate systems.

Bank Feeds & Reconciliation—Daily vs Weekly

Square-only workflows

Square automatically deposits cleared funds into your linked bank, and if you’re using Square Invoices/ Square POS alone—bank reconciliation is straightforward.

Sales deposits typically reconcile with minimal manual matching, especially given Square’s daily payouts.

Xero with Square integration

Xero/Amaka creates a “Square Balance” clearing account. Items such as fees, refunds, and payouts are imported at once, then must be matched manually to individual bank deposits.

This often leads to reconciliation mismatches and time‑consuming adjustments

Problems such as mismatched payouts, uncategorised refunds, or mis‑imported transactions may require manual cleanup or third‑party tools like Link My Books to support proper reconciliation

In practice, for daily or weekly reconciliation:

Square-only users can close off sales daily in Square, deposit the amount, and match it in their bank feed—system is clean and straightforward.

Xero users still need to log into Xero, review the clearing account, and manually organize transactions, which adds admin time each week.

Feature Set vs Complexity

Xero delivers a robust full accounting suite: general ledger, expense claims, banking integration, BAS/GST reporting, payroll (with add‑on), projects, inventory (paid upgrade), asset depreciation, budgeting, etc. It’s built for businesses that need deeper financial reporting and tax compliance.

If you want to learn Xero because you need these features in your business or you are looking to work for a business that uses Xero, then explore the Xero PRO Advanced Certificate Course.

But for micro businesses whose focus is getting paid, managing a few transactions per week, tracking a handful of expenses and staying BAS‑compliant, Square delivers essential features fast without the weight.

We’ve often emphasised Square’s affordability, free invoicing, and integrated POS as choice appeals for small traders and solo operators often overwhelmed by spreadsheet or legacy accounting platforms

This is also confirmed on independent review platforms like Software Advice and G2, Square Invoices typically outperform Xero on ease-of-use, value-for-money and user satisfaction metrics—even when compared to Xero’s mid‑tier plans

Xero is praised for its deeper capabilities, but many users voice concerns over pricing increases and limitations in lower tiers—some feel that costs have risen too steeply given their usage.