Peppol Powers eInvoicing

In 2019, the Australian government adopted Peppol, the premium eInvoice sharing framework already used by governments and businesses worldwide.

The move is set to transform the exchange of eInvoices and other eProcurement documents, delivering cost savings, along with more secure and efficient processes for government agencies and businesses of all kinds.

With its success overseas and a huge range of benefits, the framework is expanding rapidly and it can eliminate the “sorry, I didn’t receive your invoice in my email” excuse! Let’s learn a bit more about PEPPOL.

What is Peppol?

Peppol is a framework that facilitates the safe electronic exchange, within and across borders, of eInvoices and other procurement documents between business and government entities.

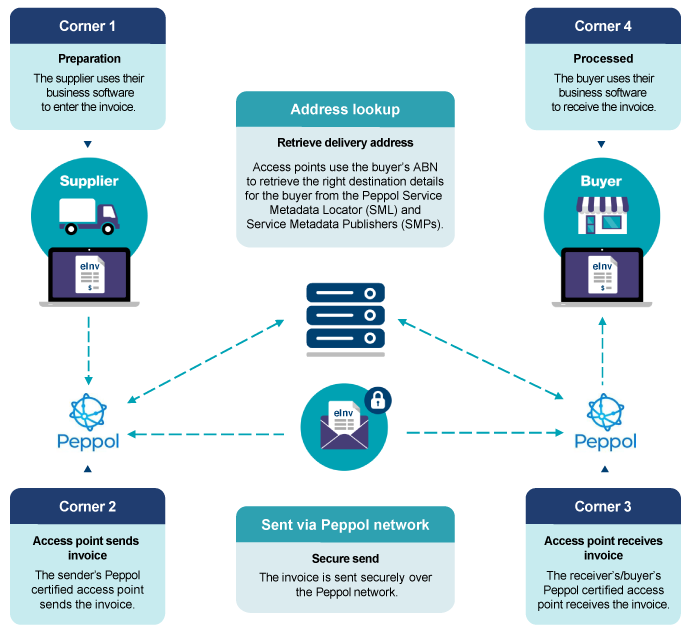

Peppol is not a transacting platform. Rather, it is a new IT infrastructure that effectively links existing eProcurement and accounting systems such as Xero, MYOB and QuickBooks that were previously unable to communicate with each other. This allows businesses using different systems to communicate with one another and exchange eDocuments, without having to adopt the same platform.

Peppol can really be thought of as a kind of “telephone network” for invoicing. That is, when you receive a call or a message to your mobile phone, you are able to immediately identify the person contacting you by their phone number.

In the same way, with Peppol you can also recognise the individual sending an invoice by their unique Peppol ID. This system eliminates identity mistakes, lost invoices and inadvertent payments to fraudulent recipients.

Peppol was developed in 2008 as an EU network and standard with the goal of simplifying and improving trade between European governments.

However, governments in nations the world over including Australia, the United States, Canada, New Zealand and Singapore, among many others, are also adopting the framework, with private operators being quick to follow suit.

Peppol in Australia

Peppol was adopted by the Australian Government in 2019. From July 2022, all Commonwealth agencies are mandated to adopt eInvoicing, and will use the Peppol framework. While state and territory government agencies are not mandated, the Australian Tax Office (ATO) – the body that administers the Australian Peppol Authority for the government – is working with them to extend use of eInvoicing.

While not a requirement for Australian businesses, many are recognising the benefits of eInvoicing, and taking the opportunity to send and receive electronic invoices straight to their software using Peppol.

Not only that, businesses are also using Peppol to exchange other eDocuments including purchase orders, catalogues, payment instructions and despatch advices, making the most of a streamlined process for exchanging essential eDocuments.

Learn how the Australian Federal Government wants to become a Top 10 Digital Economy by 2030. One of the incentives is 120% tax deduction for expenses which relate to digitising your business!

Benifits of Peppol

Fast: Taking just seconds to deliver, Peppol eInvoicing is significantly faster than transacting with paper invoices. It also eliminates the risk of lost invoices.

Safe: Peppol is much safer when compared to PDF invoices sent by email. This is because eInvoices are sent securely through the Peppol network via approved access points using the parties ABNs. This means that the dangers of receiving fraudulent invoices, being caught in an email scam, or experiencing a malicious software attack are far lower with Peppol.

In addition, the Peppol ID is unique to each user. This removes opportunities for errors such as mis-sent invoices, and inadvertent payments to incorrect recipients, including scammers.

Expanding reach: Commonwealth government agencies as well as many international suppliers are obligated to transact through Peppol. So, if you do business with any of these entities, you will need to get on board.

Not only this, many businesses are taking it up as a matter of choice for the cost and other benefits. Digitisation of business processes is becoming more and more common, and the adoption of eInvoicing is just one aspect of this.

Cost saving: Peppol greatly reduces the cost of invoice exchange.According to the ATO, paper and emailed PDF invoices cost between $27 and $30 to process, while eInvoicing can reduce this to just $10 per invoice, delivering valuable savings to your business.

Automation: With Peppol invoicing can be automated, taking care of what is for many businesses, a huge administrative load.

With all the cost, time and security benefits, will you become a “Peppol person” too?

How do I connect to Peppol?

To start sending eInvoices via the Peppol network you need to connect to a Peppol Access Point, which acts as a virtual gateway to the entire network. Once you are registered, you can reach and connect with any other user, anywhere in the world.

You can get help with connecting through an accredited service provider. All providers are listed on the ATO website, and include companies such as Xero and IBM. Each accredited service provider has different service offerings, so make sure you speak to a few to make sure that you have the best fit for your business.

Like to get on top of eInvoicing? Read about our MYOB, QuickBooks and Xero courses to take advantage of this valuable business solution.