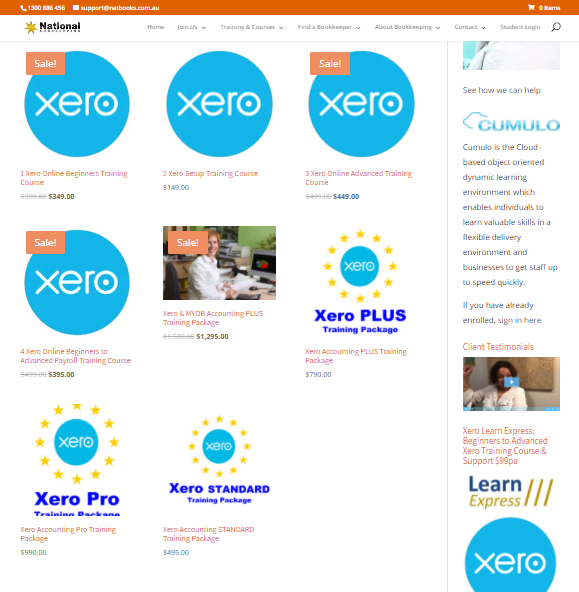

by Online Business Training Courses | Tuesday, May 7, 2024 | 10 Report on Financial Activities, Finance Training Courses Online, MYOB, News, Xero online training course, Xero Training Courses

Most people who go into small business have a skill or expertise and technical skills. Carpenters, plumbers, mechanics are classic examples and you’ll find dozens of these business owners in your local suburb. One of our own MYOB and Xero Course support team...

by Online Business Support | Tuesday, July 6, 2021 | 10 Report on Financial Activities, Airtasker, Bark.com, Business Startup Help with starting a new business, Business Tools, Career Academy, Digital Assets, Digital Marketing, Finance Training Courses Online, Marketing Training Courses Online, MYOB Training Courses, Online Business, Project Bidding, QuickBooks Online Training Courses, Small Business, small business marketing, Social and Digital Media Marketing Courses, training courses, Upwork, Xero Training Courses

The way people work is changing rapidly in a shift from the traditional 9-to-5 PAYG “jobs for life” to consultancy and contract gigs. For the last couple of years workforce trends have shown that freelance workers are being given more roles and...

by Online Business Training Courses | Wednesday, May 12, 2021 | 06 Plan small Business Finances, 10 Report on Financial Activities, Business Tools, Finance Training Courses Online, MYOB, MYOB Training Courses, National Bookkeeping, News, QuickBooks Online Training Courses, Small Business, training courses, Xero online training course, Xero Training Courses

The past year has been a tough one for everyone – there’s no doubt about that. The COVID-19 pandemic has affected thousands of industries, and small-scale farmers have been hit with one of the hardest blows. Farmers do a lot of tough labour, and they also...

by Online Business Training Courses | Friday, March 19, 2021 | 10 Report on Financial Activities, Finance Training Courses Online, Integrations, MYOB, MYOB Training Courses, News, Receipt Scanning, training courses, Xero online training course, Xero Training Courses

We’ve written a couple times in the past about whether you should use FREE Accounting software and how some FREE or cheap accounting programs offered features which were considered advanced by companies like Xero. Sadly, it has become obvious why you...

by Online Business Training Courses | Friday, October 23, 2020 | 10 Report on Financial Activities, Business Startup Help with starting a new business, Career Academy, Career Training and Upskilling, Finance Training Courses Online, Internships, MYOB, MYOB Training Courses, National Bookkeeping, News, training courses, Xero online training course, Xero Training Courses

Our customer service team recently spoke with a lady with fantastic work experiences in financial roles. She is 54 and had positions like treasurer for a Not-For-Profit organisation, assistant to an accountant and even managed all accounting aspects of a family...

by Online Business Training Courses | Monday, July 2, 2018 | 10 Report on Financial Activities, Business Secrets, Finance Training Courses Online, National Bookkeeping, News, Small Business, training courses

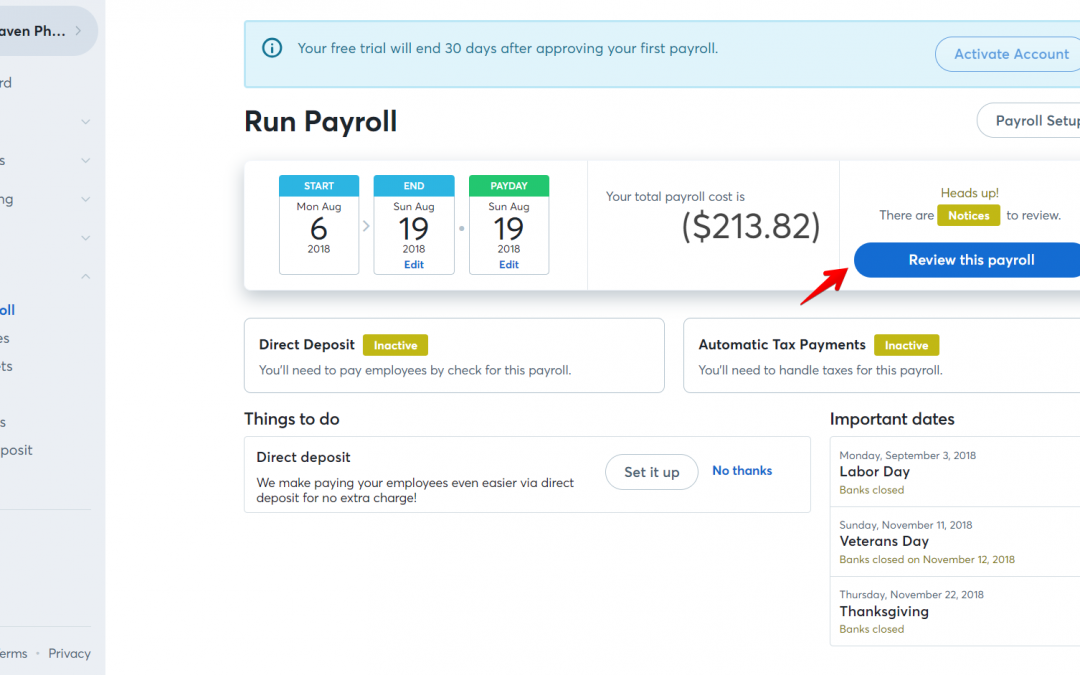

The Different Kinds of Bookkeeping Professionals If you dread having to prepare and maintain your financials and are spending way too much time on all of this, then you’re going to save time (and inevitably money) by hiring a professional to do it for you. But...

by Online Business Training Courses | Wednesday, March 14, 2018 | 10 Report on Financial Activities, Business Tools, Finance Training Courses Online, MYOB, News, Small Business, small business management, Xero online training course

SBR is making it easier to lodge your reports In 2010, the Australian government launched an initiative to simplify business reporting obligations, by enabling the accounting software to populate information from various government reports to save businesses time and...

by Online Business Training Courses | Tuesday, June 6, 2017 | 06 Plan small Business Finances, 10 Report on Financial Activities, Business Startup Help with starting a new business, Business Tools, Finance Training Courses Online, Small Business, small business management, training courses, Xero online training course

Cashed-based business? Time to move ahead CASH CONTINUES TO be common in some types of businesses. However, the ATO urges Australian businesses to be aware of the numerous advantages of electronic payment and record keeping systems — especially in the long run. The...

by Online Business Training Courses | Thursday, December 18, 2014 | 10 Report on Financial Activities, 13 Valuations and Raising Capital, MYOB, News, small business management

Pay a Success-Based Tax If you’ve ever owned an investment property, you know about capital gains tax (CGT). It’s that nasty little tax you pay on any gain you make when you sell or dispose of capital. There are exceptions, of course. If the property is your primary...

by Online Business Training Courses | Thursday, June 12, 2014 | 02 Market the small Business (Business Planning), 10 Report on Financial Activities, 11 Selling your products or services, small business management

Our Small Business Management Course is designed to give you everything you need to create a well thought out and researched business plan that you can use as a blueprint to achieve your goals. One of the topics is ‘Business Planning’ — you could just as...