by Online Business Training Courses | Thursday, April 13, 2023 | 05 Researching the Market, 07 Marketing Action Plan, 08 Undertake Marketing Activities, 12 Customer Service, 14 Networking & Referrals, Bookkeeping Courses, Digital Marketing, Finance Training Courses Online, Marketing Training Courses Online, National Bookkeeping, News, Sales Training Courses Online, Xero online training course

The huge difference between accounts staff (and technical support staff) and sales staff is fascinating. It’s the classic difference between staff who are technically trained and aim to perform accurate data entry or fix detailed problems versus sales people who...

by Online Business Training Courses | Friday, April 7, 2023 | 02 Market the small Business (Business Planning), 05 Researching the Market, 11 Selling your products or services, 12 Customer Service, 14 Networking & Referrals, Bookkeeping Courses, Business Startup Help with starting a new business, Database & Email Marketing, Digital Marketing, Finance Training Courses Online, How to Price Work, Marketing Training Courses Online, News, Sales Training Courses Online, Small Business, Value Pricing

I had the pleasure of meeting Michelle and being her first customer for her brand new cleaning business. Michelle was excited and nervous but had the support from someone who was experienced in running a cleaning business with her. Michelle did a fantastic job and...

by Linda Roberts | Wednesday, April 27, 2022 | 12 Customer Service, Accounts Receivable, Bookkeeping Courses, Business Tools, Finance Training Courses Online, MYOB, MYOB Training Courses, News, Online Business, QuickBooks Online Training Courses, Small Business, Xero online training course, Xero Training Courses

Peppol Powers eInvoicing In 2019, the Australian government adopted Peppol, the premium eInvoice sharing framework already used by governments and businesses worldwide. The move is set to transform the exchange of eInvoices and other eProcurement documents, delivering...

by Luke Williams | Tuesday, April 26, 2022 | Bookkeeping Courses, Finance Training Courses Online, News, Xero online training course, Xero Training Courses

Is there a particular issue that keeps bugging you and is stopping your business from moving forward? We know how frustrating it can be when you have a business problem you just can’t get past. It’s not just frustrating either, it can be draining...

by Online Business Training Courses | Thursday, September 23, 2021 | Become a Virtual Assistant, Business Startup Help with starting a new business, Buy an Online Business, Career Academy, Career Training and Upskilling, Finance Training Courses Online, MYOB Training Courses, Online Business, Small Business, training courses

MYOB seems to have a way of upsetting their users and partner regularly and this time it is because of a recent upgrade they made to their MYOB Essentials Software. We heard from a student and a Virtual Assistant and read many bad user reviews online. Virtual...

by Online Business Support | Friday, August 6, 2021 | 05 Researching the Market, Business Tools, Career Academy, Digital Assets, Finance Training Courses Online, Internships, News, Online Business, Small Business, training courses, Xero online training course, Xero Training Courses

Source: google.com The harsh truth is that most people will get hacked at some point in their lives. Hacking can happen to the biggest and smartest of companies and their strongest security efforts. People are vulnerable to password theft when they: use the same...

by Online Business Support | Tuesday, July 6, 2021 | 10 Report on Financial Activities, Airtasker, Bark.com, Business Startup Help with starting a new business, Business Tools, Career Academy, Digital Assets, Digital Marketing, Finance Training Courses Online, Marketing Training Courses Online, MYOB Training Courses, Online Business, Project Bidding, QuickBooks Online Training Courses, Small Business, small business marketing, Social and Digital Media Marketing Courses, training courses, Upwork, Xero Training Courses

The way people work is changing rapidly in a shift from the traditional 9-to-5 PAYG “jobs for life” to consultancy and contract gigs. For the last couple of years workforce trends have shown that freelance workers are being given more roles and...

by Online Business Support | Wednesday, May 19, 2021 | 09 Monitor & Manage Small Business Operations, 15 Hiring Staff, Increasing Performance and Retaining Good People, Bookkeeping Courses, Business Tools, Finance Training Courses Online, Payment Methods, Payroll Administration Training Courses, QuickBooks Online Training Courses, Rostering & Payroll Administration

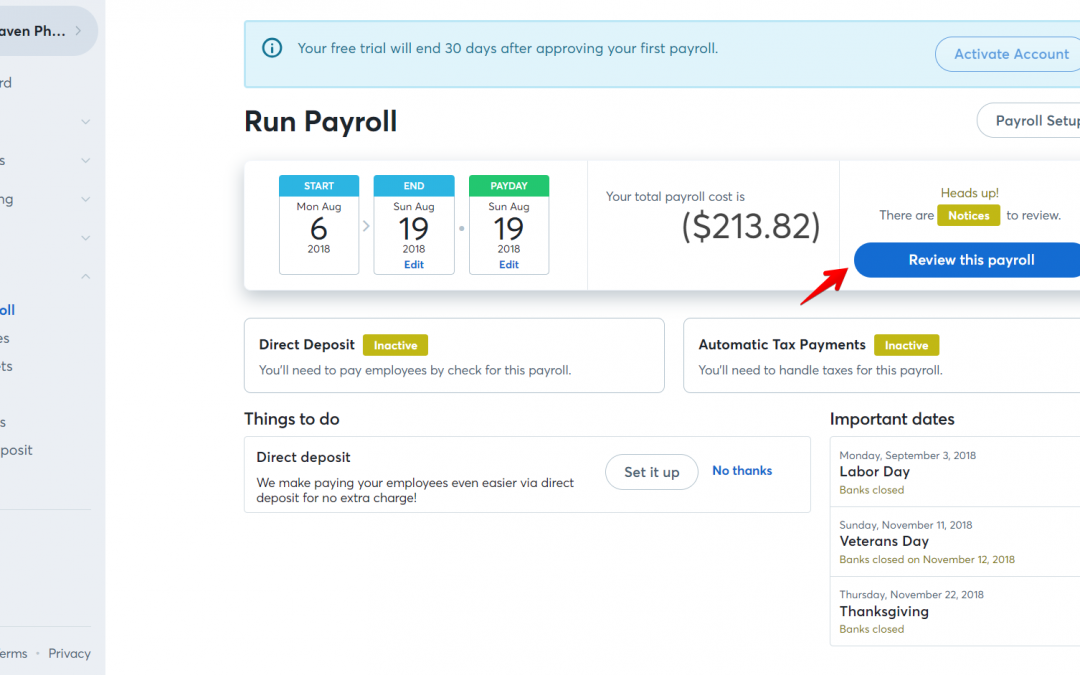

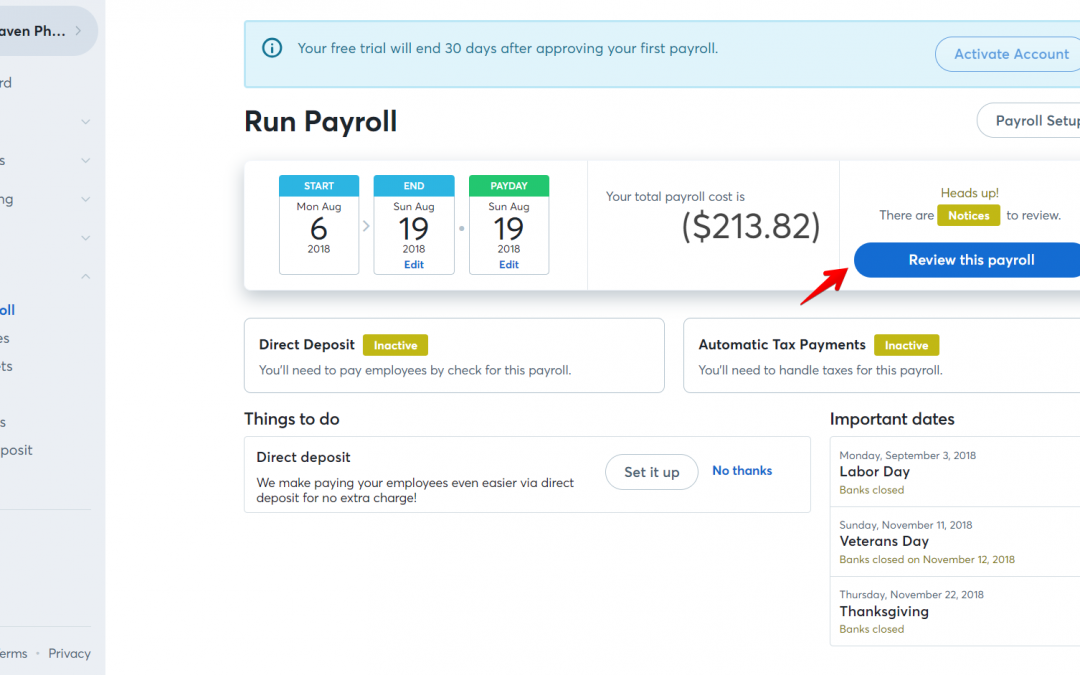

A big challenge for many small businesses is knowing which award to use for new employees. Modern awards are complex, and keeping track of penalty rates and loadings can be a long and drawn-out process. QuickBooks Online Payroll holds the key to simplifying award...

by Online Business Training Courses | Wednesday, May 12, 2021 | 06 Plan small Business Finances, 10 Report on Financial Activities, Business Tools, Finance Training Courses Online, MYOB, MYOB Training Courses, National Bookkeeping, News, QuickBooks Online Training Courses, Small Business, training courses, Xero online training course, Xero Training Courses

The past year has been a tough one for everyone – there’s no doubt about that. The COVID-19 pandemic has affected thousands of industries, and small-scale farmers have been hit with one of the hardest blows. Farmers do a lot of tough labour, and they also...

by Online Business Training Courses | Friday, March 19, 2021 | 10 Report on Financial Activities, Finance Training Courses Online, Integrations, MYOB, MYOB Training Courses, News, Receipt Scanning, training courses, Xero online training course, Xero Training Courses

We’ve written a couple times in the past about whether you should use FREE Accounting software and how some FREE or cheap accounting programs offered features which were considered advanced by companies like Xero. Sadly, it has become obvious why you...

by Online Business Training Courses | Friday, October 23, 2020 | 10 Report on Financial Activities, Business Startup Help with starting a new business, Career Academy, Career Training and Upskilling, Finance Training Courses Online, Internships, MYOB, MYOB Training Courses, National Bookkeeping, News, training courses, Xero online training course, Xero Training Courses

Our customer service team recently spoke with a lady with fantastic work experiences in financial roles. She is 54 and had positions like treasurer for a Not-For-Profit organisation, assistant to an accountant and even managed all accounting aspects of a family...

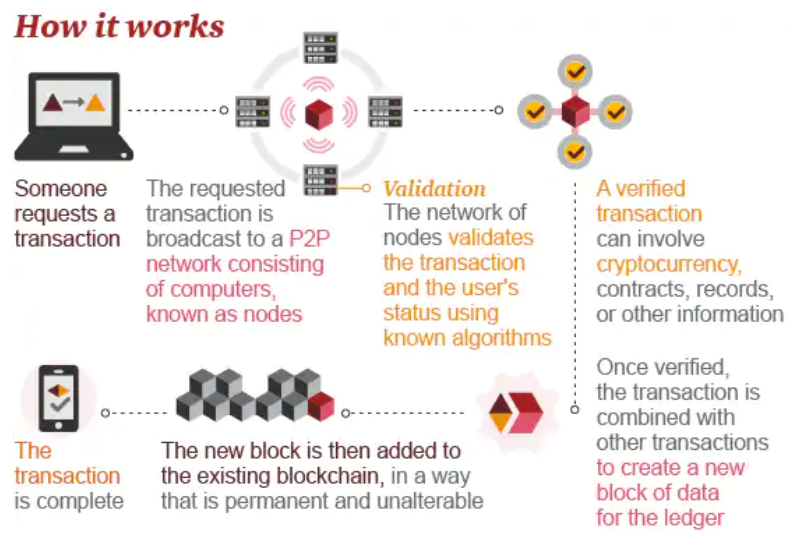

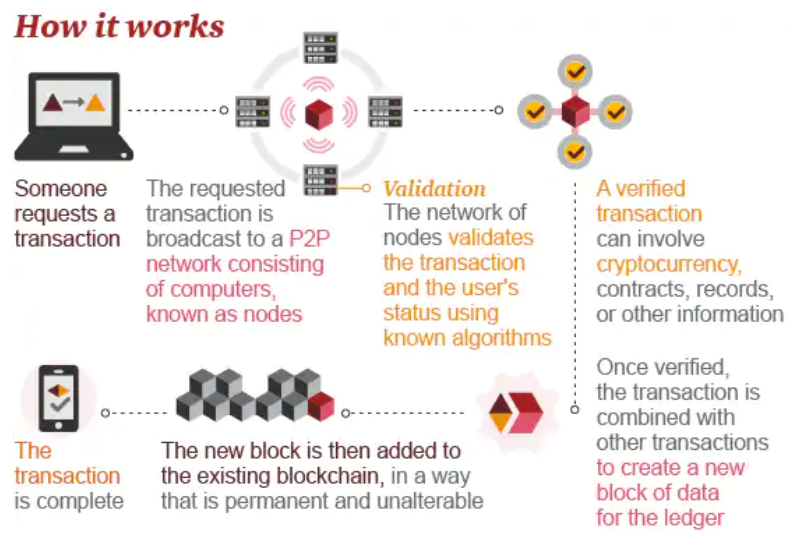

by Online Business Training Courses | Friday, June 14, 2019 | Credit Cards, Crytocurrency, Finance Training Courses Online, News, Payment Methods

Getting paid is the reward for going into business (or being an employee) and performing work for customers who need you. Cash has always been king but now most payments are electronic using a credit card, but still in Aussie dollars (or which ever country you live...